Institutional ownership increased from 87.4 M shares as of June 13 to 97.6 M shares as of June 30

On May 17 GameStop announced plans to sell up to 45 million shares, and on May 24th they announced that all 45 million shares were sold for $933 million, at an average price of about $20.73.

Modifying shares outstanding from 306 million to 351 million is an approximately 15% dilution. A shareholder could have expected the value of their own share holdings to have dropped 15% from this action, but shareholder value hardly went down at all as a consequence of the dilution and in fact is up about 75% from May 1 to May 24.

"Held at" DTC versus Computershare

As of March 20, 2024 there were 305,873,200 shares of GameStop's Class A common stock (GME) outstanding.

"Of those outstanding shares, approximately 230.6 million were held by Cede & Co on behalf of the Depository Trust & Clearing Corporation (or approximately 75% of our outstanding shares) and approximately 75.3 million shares of our Class A common stock were held by registered holders with our transfer agent (or approximately 25% of our outstanding shares)."

-

25% of issued shares of GME are owned by directly registered shareholders

-

The other 75% is held by Cede & Co on behalf of the DTCC

As of May 24, 2024, GameStop completed an at the market equity offering, and sold 45,000,000 shares, increasing the total amount of shares outstanding to approximately 351,000,000.

DRS vs DSPP

Information about DRS versus DSPP counts held at Computershare are not reported publicly.

This information is available, however, on the GameStop stockholder list which can be viewed in person at GameStop headquarters.

The latest data we have was from 2023 when GME shareholders viewed the stockholder list and obtained some data including DRS vs DSPP counts. Source: https://www.drsgme.org/2023-stock-list-viewing

The DRS vs DSPP numbers in the graphic have been rounded for simplicity based off the data from that 2023 source.

Of shares held by Computershare: 53 million DRS, 22 million DSPP.

| Before ATM | After ATM (May 24) | |

|---|---|---|

| Shares outstanding (approx) | 305,000,000 | 350,000,000 |

| Cash on hand (approx) | $1 billion | $2 billion |

| DRS % of outstanding shares (approx 75 million DRS) | 24.7% | 21.4% |

May 24, 2024

GRAPEVINE, Texas, May 24, 2024 (GLOBE NEWSWIRE) -- GameStop Corp. (NYSE: GME) (“GameStop” or the “Company”) today announced that it has completed its previously disclosed “at-the-market” equity offering program (the “ATM Program”).

GameStop disclosed on May 17, 2024 that it filed a prospectus supplement with the U.S Securities and Exchange Commission to offer and sell up to a maximum amount of 45,000,000 shares of its common stock from time to time through the ATM Program. The Company sold the maximum number of shares registered under the ATM Program for aggregate gross proceeds (before commissions and offering expenses) of approximately $933.4 million.

GameStop intends to use the net proceeds from the ATM Program for general corporate purposes, which may include acquisitions and investments.

YouTube Video

Click to view this content.

Noticed this post on reddit, decided to give this >40 minute documentary a watch.

A review of GAMESTOP to the MOON - How Reddit almost triggered an Economic Crisis | FD Finance

★★☆☆☆

2/5, would not recommend.

TLDR: documentary focuses primarily on the events of late 2020 and early 2021, conflates AMC and GME as equivalent things, concludes with the insinuation that all AMC, GME, and NFT investors are losers that have lost almost everything

----

-

Title of the documentary does not match the content of the documentary. A more appropriate title might have been "the story of Reddit day traders pumping AMC and GME." That is what this documentary was about.

-

paints most of these investors as either foolish day traders or naive investors, uses words like "gambling", "casino"

-

lots of FUD sentiment throughout

-

a few of these investors made a lots of money while most investors were losers

-

32:04 "GameStop led the way. And, as a group, the totality of the group picked AMC next. And, it wasn't like somebody said oh man we're all gonna go over to AMC, it's just kind of you know, that's where the flow goes, that's where the chatter goes, and AMC was the next stock."

-

for some reason, out of nowhere, in the final 5 minutes the documentary suddenly starts talking about NFTs and makes them out to be pointless. Doesn't mention GameStop's relationship with NFTs but in stead focuses on how NFTs were a speculative bubble with foolish investors, just like with AMC and GME.

-

-

Total waste of time. I don't know who the intended audience was for this, but this is just more pointless narrating about the lives of people that experienced events that happened 3 years ago, concluding that the story is over and all those people that didn't get out with gains are losers that are never going to win.

It's as if the media like this is stuck in the year 2021. Reddit. Wallstreetbets. AMC. GameStop. Day traders. Robinhood. Down 90% since peak. The end.

never left, not leaving. will be buying more shares and putting them in my name

thanks for your concern though

Here is another representation of GameStop's FY23 income statement, this time showing clearly that GameStop had an operating loss of $34.5 M ( compared with an operating loss of $311 M FY22 !)

If not for the $49.5 M from interest income, GameStop would not have had positive net earnings in FY23.

Operating loss of $35 M (compared with operating loss of $312 M in FY22)

Small but notable net earnings of $6.7 M (compared with net loss of $313 M in FY22)

How did GameStop make $50 million in interest income?

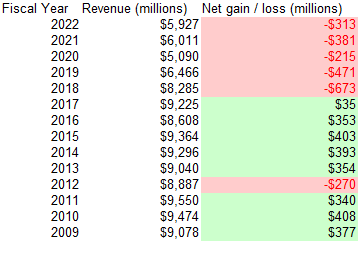

GameStop was profitable for the first time in 6 years

GameStop reported full-year profitability for fiscal year 2023, contradicting the prevailing media sentiment that GameStop is a terrible company destined for bankruptcy

Summary

- On March 26, 2024, GameStop released financial results for the fourth quarter and fiscal year ended February 3, 2024, demonstrating small but not insignificant full-year profits for the first time in 6 years, despite reduced revenues. "Net income was $6.7 million for fiscal year 2023, compared to a net loss of $313.1 million for fiscal year 2022."

- Sentiment of GameStop found in financial media continues to be negative, dishonest, and cynical, despite the undeniable but often ignored improvements to the fundamentals of the company that have been achieved by the new management team. In most cases, the fact that GameStop was profitable for the first time in 6 years is not even mentioned at all.

-

-

Historical context

From a historical point of view, GameStop was consistently profitable every fiscal year from 2005 through 2016, with the exception of 2012. Starting in fiscal year 2017, GameStop began showing reduced profitability, and from FY 2018 through FY 2022, was unprofitable.

Source: GameStop 10-K filings - Google Sheets

Looking exclusively at revenue, it is clear that there has been a significant reduction starting approximately with fiscal year 2019. Much of this can be attributed to the fact that gamers are increasingly buying games digitally rather than in the form of physical discs such as can be purchased at a brick-and-mortar retail store like GameStop.

Yet, even in fiscal years 2017 and 2018, it is clear that despite high revenues the company was not performing well.

Heading through 2020, GameStop was undeniably a struggling company facing significant challenges, and according to many was destined for bankruptcy. The trading price of GME reflected this prevailing sentiment, and the financial media was dutifully critical.

Company turnaround

In 2020, activist investor Ryan Cohen began purchasing shares of GME, ultimately becoming the largest individual owner of the company with approximately 12% ownership. By June 2021, the entire board of directors of the company was replaced by Ryan Cohen and his associates, with Ryan Cohen becoming chairman of the board. From this time onward, control of the company was completely in the hands of this new leadership team.

>"We inherited a bunch of legacy everything, and under-investment across the entire business –- people, the entire technology stack, just decades of neglect, and so it’s hard to turn around a brick and mortar retailer that’s under the kind of pressure that GameStop was and continues to be under, but that was also part of the attraction going into GameStop was that a transformation the likes of GameStop was really unprecedented and I was motivated by that."

The company went from a situation where it was losing hundreds of millions of dollars per year to net profitability in fiscal year 2023.

While this is an undeniably positive result for the company in this time period, GameStop continues to face numerous challenges and must continue to improve and adapt in order to successfully compete in the modern video game industry.

Media sentiment

What does mainstream financial media have to say about GameStop achieving full-year profitability for the first time in 6 years?

-

GameStop faces 'unsustainable' sales decline, cuts jobs to control costs

- Focuses on job cuts, reduced revenue, leans on the opinion of Michael Pachter

- Fails to mention GameStop achieving full-year profitability

-

GameStop Q4 Earnings Highlights: Retail Favorite Stock Plunges After Revenue, EPS Miss

- Emphasis on GME share price going down

- Focuses on reduced revenue

- Did mention some favorable facts

- Fails to mention GameStop achieving full-year profitability

-

GameStop Stock Plummets Following Q4: Profitability Fails to Offset Significant Revenue Miss

- Headline emphasizes GME share price is down

- Makes clear that GameStop achieved full-year profitability for the first time in years

- Generally fair reporting of other facts

-

GameStop Stock Plunges After Earnings Fall Short of Expectations—Key Level to Watch

- Headline emphasizes GME share price is down, 'expectations' were missed

- Focus on job cuts, reduced revenue

- Fails to mention GameStop achieving full-year profitability

-

Jim Cramer Says GameStop Is Arguably The Worst Company In America

- Article is entirely negative, leans on the opinions of Jim Cramer and Michael Pachter

- Fails to mention GameStop achieving full-year profitability

-

- Makes clear and emphasizes contextual significance of GameStop's full-year profitability

- Generally positive about GameStop's financial circumstances

-

GameStop could be gone in less than 5 years, says analyst

- Article is almost entirely negative, leans on the opinions of Michael Pachter

- Does mention GameStop's positive cash holdings of $1.2 billion

- Claims that Reddit's WallStreetBets has 'seemingly walked away from the “stonk”', fails to mention that GME discussion is censored on WallStreetBets (formally banned by the moderators in 2022), fails to mention that GME shareholders are found in different online communities

- Fails to mention GameStop achieving full-year profitability

-

GameStop Needs To Get Its Game Back

- Focuses on reduced revenue, job cuts

- Weak mention of GameStop posting a full-year profit of $6.7 million

- Generally fair assessment of the struggles faced by GameStop

-

GameStop Confirms More Layoffs, Share Price Tumbles After Sales Slide

- Headline emphasizes job cuts, GME share price is down

- Generally neutral article

- Does mention GameStop's full-year profitability

-

A Sales Slump Is the Kiss of Death for GameStop Stock

- Entirely negative article, leans on the opinion of Michael Pachter

- Fails to mention GameStop achieving full-year profitability

- 'If you value your wealth, just stay away from GameStop stock.'

-

GameStop saga ends. Winner: capital markets

- Entirely negative article, leans on the opinion of Michael Pachter

- Focuses on GME share price being down

- Fails to mention GameStop achieving full-year profitability

- 'In this case, “shorts” were right... The meme army may have lost, but perhaps next time will be clearer-eyed.'

-

GameStop Stock: Is This The End of a Saga Or Just Another Chapter?

- Despite any sentiment implied by the headline, this article provides a mostly neutral assessment of GameStop's circumstances

- Mentions GameStop achieving full-year profitability

Searching for recent news about GameStop yields mostly negative sentiment that fails to even mention at all that GameStop achieved full-year profitability for the first time in 6 years.

Failing to mention this important detail is a deliberate decision that reveals a clear bias in the media. It goes beyond just reporting about true negative facts about GameStop. It demonstrates a deliberate effort, by those culpable writers and media outlets, to propagate a specific sentiment about the company that is not allowed to even mention contextually important true positive facts about the company.

GameStop was profitable for the first time in 6 years - this is the news headline that captures the significance of GameStop's recent earnings report. Yet, an unassuming person who consumes mainstream financial media likely would not even learn about this important fact at all.

Who would benefit from that?

Ongoing financial conflict

Why are there competing, mutually exclusive narratives?

There are competing narratives because there are competing financial interests.

One of the listed news articles, GameStop saga ends. Winner: capital markets, from Reuters, draws some attention to this ongoing conflict while declaring that the conflict is actually over and one side has won and one side has lost.

GME shareholders that believe in the company turnaround and leadership, despite the real challenges faced by GameStop, have a vested financial interest in the success of the company, with a desire for the share price of GME to go up, and naturally will promote the narrative that supports this financial interest.

In opposition to GME shareholders are all of the financial market participants that have a vested financial interest in the share price of GME going down. An example of such a participant would be any hedge fund that has a net short position on GME. The article refers to this faction as "shorts", recogonizing that such a faction with an interest does exist. Naturally, members of this faction will promote the narrative that supports their financial interest.

If the prospect of GameStop's success was not an ongoing threat to one faction of incumbent market participants, then there would be no reason to deliberately omit the fact of GameStop's profitability, to pretend that it isn't something that even happened at all.

Recognizing that there is an ongoing financial competition between factions that stand to benefit financially from a particular outcome of the GME share price, which faction benefits when most mainstream financial media articles propagate negative sentiment about GameStop and deliberately ignore the contextually significant fact that GameStop was profitable?

It is clear: much of mainstream financial media is actively propagating biased narratives to the benefit of the faction that has a vested financial interest in the share price of GME going down.

An interactive version of this article can be found at gmetimeline.org/fy23-profitability

you could sell directly from computershare into a Wise account

For the first 3 quarters of FY 2023, GameStop has posted a total net loss of $56.4 million.

Therefore, in order to achieve full-year profitability, GameStop must achieve greater than $56.4 million in net profit for Q4 2023.

This is certainly achievable, though not guaranteed.

Something like a $100 million net gain for Q4 is possible, but not necessarily very likely.

Therefore, in any case of full-year profitability, at best, the PE ratio for GME will almost certainly be above 100, but will more likely be in the several hundreds, or worse.

By comparison, the average PE ratio for S&P500 is around 25.

https://www.macrotrends.net/2577/sp-500-pe-ratio-price-to-earnings-chart

Some PE ratios of other companies:

- Microsoft: 37

- Apple: 26

- Nvidia: 213

- Amazon: 89

- Alphabet: 27

- Meta: 42

- Berkshire Hathaway: 10

TLDR: Full-year profitability will be a momentous achievement, but in almost all cases, GME would have a very high PE ratio. Over the following quarters / years, GameStop will still need to increase profits substantially in order to obtain a good PE ratio.

it may very well be one of the last good opportunities to get some GME for cheap.

Either GameStop achieves full-year profitability, or they don't.

GameStop's opponents (those hedge funds and other participants holding a short position seeking the stock price to go down), and their useful bought and paid for media puppets, are well aware of the situation we are in, probably even more aware than most GME shareholders.

Full-year profitability is the target. It's the thing that most shareholders and opponents have their mind on, in terms of material things that matter that could change the narrative, change the dynamic, and ultimately lead towards true price discovery.

If GameStop fails to achieve full year profitability, (e.g. net quarterly earnings for 2023 Q4 to be any amount less than positive ~ $57 million), then this will give the opponents an opportunity to pile on negative sentiment and hit the price down. "After 3 years in control of the company, Ryan Cohen and team fail to achieve widely-expected profitability, stock price down XX %". As a shareholder I obviously hope that this is not the outcome, but I'll be happy with any general improvements to the company's financial standing.

but I think that this is a very achievable target. Net positive $57 million for 2023 Q4 will give full-year profitability for FY 2023. Any number above that is a major success, and completely feasible. Not guaranteed by any means, but realistically achievable.

And if this is achieved, then it shoots a giant hole in the persistent negative media narrative that has been put upon GameStop these past few years by dishonest and manipulative wall street incumbents and their dishonest and manipulative friends in the financial media.

in the scenario of full-year profitability, some positives with respect to an investment in GME:

- Full-year profitability. This would be the first year in 6 years that GameStop would achieve this profitability. The last time was in FY 2017. Undeniable evidence of successful turnaround efforts.

- cash in the bank to the tune of around $1 billion, unless significant amounts are spent on something such as an investment or a merger/acquisition, which would itself likely be positive news.

- no debt* (except perhaps the negligible French loan. it would be nice to be able to say no debt, definitively, without an asterisk. will this loan still be outstanding in any amount?).

- The video gaming industry is a $200 billion per year industry, and growing, larger than movies, music, and books combined.

- GameStop continues to make improvements to their business including for example in e-commerce, internal processes, new ventures

Obviously, not everything is sunshine and rainbows. GameStop still faces headwinds and has many competitors. In the long term, GameStop also needs to dramatically grow top-line revenue if it ever wants to become the giant that many shareholders believe it to be. These are not small accomplishments.

In the short term, in the face of the achievement of full-year profitability, and all the other positives that GameStop has going for it, how can the media sentiment towards GameStop continue to be so negative and cynical? Surely they will try, but it will become increasingly untenable to try and spin negativity about a situation that is very obviously positive. The negative media narrative is there to try and prevent additional investors from ever considering GME as a valid investment. But at some point the truth of the fundamentals become more powerful than the lies of the media. All it will take is some significant buying pressure and the price could break out.

Who knows what will happen.

I hope GameStop reports $57 million or more in net earnings for Q4 2023. We'll find out in less than 2 weeks.

i disagree with the assertion that heat lamp has been debunked, though it seems like some people really want people to necessarily believe this to be true and final.

put aside the name "heatlamp theory" and address 2 of the main points:

-

- Plan is not DRS. "Plan is not DRS" is not debunked, just because GameStop rejected the shareholder proposals, or that there were issues with the shareholder proposals. The simple fact remains, that plan shares are not DRS shares.

-

- On some DRS record dates, there have been large spikes in volume. Heat lamp offers a possible explanation for how / why. It is a theory, and it isn't necessarily totally right. But, if not right, then how else are these volume spikes explained? To my knowledge, nobody else has put together a thoughtful explanation as to why volume of GME traded spikes on some but not all DRS record dates.

Okay, so heat lamp as originally proposed might not be the fully accurate explanation for the volume spikes. So what are the alternative explanations then?

Something worth noting is that there seems to be a very effortful push to authoritatively declare "DEBUNKED!" without explaining specifically how it is debunked, and without providing any alternative explanations.

- Observation: GME volume spikes on some DRS record dates.

- Theory: "i propose that the reason why this happens is because..."

- Opposition: "Heatlamp is definitively debunked and there is no other explanation!"

Plan is not DRS is a true statement and is not debunked.

GME has unusual trading volume on some DRS record dates, this is another true observation that is not debunked.

One theory that attempts to tie these things together might not be completely accurate but to my awareness is the most thoughtful explanation that exists thus far. I'd love to see alternative explanations but I don't know of any. Superstonk mods by consensus are opposed to the notion that there is any validity to heatlamp theory, yet offer absolutely nothing else as an alternative.

TLDR: "heatlamp is debunked" is just another example of narrative control being perpetrated by a group of moderators of the largest GME internet community. More information is needed to make any kinds of authoritative claims.

exciting!

with respect to GME, filing date for Q4 is usually mid March

| Quarter | Filing Date | Document Date |

|---|---|---|

| Q4 2022 | March 21, 2023 | January 28, 2023 |

| Q4 2021 | March 17, 2022 | January 29, 2022 |

| Q4 2020 | March 23, 2021 | January 30, 2021 |

| Q4 2019 | March 26, 2020 | February 1, 2020 |

| Q4 2018 | April 2, 2019 | February 2, 2019 |

Updated image, original image was missing Technology Brands stores for FY 2013.

Breakdown of GameStop stores by Technology Brands stores versus Video Game Brands stores versus all International stores

And for fun,

GameStop Net Income Per Store

| Fiscal Year | Revenue | Net Income | Store Count | Revenue Per Store | Net Income Per Store | 10-K | |-------------|----------------|---------------|-------------|-------------------|----------------------|------| | 2005 | $3,091,783,000 | $100,784,000 | 4490 | $688,593.10 | $22,446.33 | link | | 2006 | $5,318,900,000 | $158,250,000 | 4778 | $1,113,206.36 | $33,120.55 | link | | 2007 | $7,093,962,000 | $288,291,000 | 5264 | $1,347,637.16 | $54,766.53 | link | | 2008 | $8,805,897,000 | $398,282,000 | 6207 | $1,418,704.20 | $64,166.59 | link | | 2009 | $9,077,997,000 | $377,265,000 | 6450 | $1,407,441.40 | $58,490.70 | link | | 2010 | $9,473,700,000 | $408,000,000 | 6670 | $1,420,344.83 | $61,169.42 | link | | 2011 | $9,550,500,000 | $339,900,000 | 6683 | $1,429,073.77 | $50,860.39 | link | | 2012 | $8,886,700,000 | -$269,700,000 | 6602 | $1,346,061.80 | $40,851.26 | link | | 2013 | $9,039,500,000 | $354,200,000 | 6675 | $1,354,232.21 | $53,063.67 | link | | 2014 | $9,296,000,000 | $393,100,000 | 6690 | $1,389,536.62 | $58,759.34 | link | | 2015 | $9,363,800,000 | $402,800,000 | 7117 | $1,315,694.82 | $56,596.88 | link | | 2016 | $8,607,900,000 | $353,200,000 | 7535 | $1,142,388.85 | $46,874.59 | link | | 2017 | $9,224,600,000 | $34,700,000 | 7276 | $1,267,811.98 | $4,769.10 | link | | 2018 | $8,285,300,000 | -$673,000,000 | 5830 | $1,421,149.23 | $115,437.39 | link | | 2019 | $6,466,000,000 | -$470,900,000 | 5509 | $1,173,715.74 | $85,478.31 | link | | 2020 | $5,089,800,000 | -$215,300,000 | 4816 | $1,056,852.16 | $44,705.15 | link | | 2021 | $6,010,700,000 | -$381,300,000 | 4573 | $1,314,388.80 | $83,380.71 | link | | 2022 | $5,927,200,000 | -$313,100,000 | 4413 | $1,343,122.59 | $70,949.47 | link |

The link is in the post, they are all on that page, but here:

As a reminder, shareholder proposals are submitted by real people with real names. As a matter of courtesy it would be appropriate to respect the privacy of these individuals as much as possible.

And to my awareness, it does not matter which country a shareholder resides in, the qualifications to submit a proposal are only that a shareholder has held a minimum dollar value of shares for a minimum amount of time, as specified here:

- ≥$2,000 for at least 3 years, OR

- ≥$15,000 for at least 2 years, OR

- ≥$25,000 for at least 1 year

| Fiscal Year | Revenue | Net Income | Store Count | Revenue Per Store | Net Income Per Store | 10-K | |-------------|----------------|---------------|-------------|-------------------|----------------------|------| | 2005 | $3,091,783,000 | $100,784,000 | 4490 | $688,593.10 | $22,446.33 | link | | 2006 | $5,318,900,000 | $158,250,000 | 4778 | $1,113,206.36 | $33,120.55 | link | | 2007 | $7,093,962,000 | $288,291,000 | 5264 | $1,347,637.16 | $54,766.53 | link | | 2008 | $8,805,897,000 | $398,282,000 | 6207 | $1,418,704.20 | $64,166.59 | link | | 2009 | $9,077,997,000 | $377,265,000 | 6450 | $1,407,441.40 | $58,490.70 | link | | 2010 | $9,473,700,000 | $408,000,000 | 6670 | $1,420,344.83 | $61,169.42 | link | | 2011 | $9,550,500,000 | $339,900,000 | 6683 | $1,429,073.77 | $50,860.39 | link | | 2012 | $8,886,700,000 | -$269,700,000 | 6602 | $1,346,061.80 | $40,851.26 | link | | 2013 | $9,039,500,000 | $354,200,000 | 6675 | $1,354,232.21 | $53,063.67 | link | | 2014 | $9,296,000,000 | $393,100,000 | 6690 | $1,389,536.62 | $58,759.34 | link | | 2015 | $9,363,800,000 | $402,800,000 | 7117 | $1,315,694.82 | $56,596.88 | link | | 2016 | $8,607,900,000 | $353,200,000 | 7535 | $1,142,388.85 | $46,874.59 | link | | 2017 | $9,224,600,000 | $34,700,000 | 7276 | $1,267,811.98 | $4,769.10 | link | | 2018 | $8,285,300,000 | -$673,000,000 | 5830 | $1,421,149.23 | $115,437.39 | link | | 2019 | $6,466,000,000 | -$470,900,000 | 5509 | $1,173,715.74 | $85,478.31 | link | | 2020 | $5,089,800,000 | -$215,300,000 | 4816 | $1,056,852.16 | $44,705.15 | link | | 2021 | $6,010,700,000 | -$381,300,000 | 4573 | $1,314,388.80 | $83,380.71 | link | | 2022 | $5,927,200,000 | -$313,100,000 | 4413 | $1,343,122.59 | $70,949.47 | link |

As many are aware, the SEC recently published Incoming No-Action Requests Under Exchange Act Rule 14a-8, and there were several shareholder proposals submitted by GME shareholders that were rejected by the company that were published there.

There have already been a few discussions of these proposals on Reddit and on X and on Discord at least.

Some of the discussions about the rejected proposals have been nothing but negative and cynical and even disparaging towards those shareholders that submitted proposals.

So I just wanted to make this post to express some gratitude towards those shareholders that submitted a proposal, despite that GameStop rejected them.

It's really easy to criticize. It's very easy to sit behind a keyboard and put other people down while otherwise contributing nothing. It takes almost no effort to do this.

It's hard to build things, it's much easier to destroy things.

Those shareholders that submitted proposals are the types of people that are builders. They are activists. They are building and advancing our collective knowledge.

Some other people are not builders. They are destroyers. They revel when the builders struggle. They celebrate when the builders face setbacks. They scorn and shame the builders for having tried at all.

I sincerely appreciate the efforts of any shareholder that took the time and energy to submit a proposal, any proposal at all, even if it gets rejected.

Every little thing that GME shareholders do that produces additional knowledge is beneficial overall to all shareholders.

Some parties out there in the world that are in opposition to GME shareholders don't like this. They don't like it when GME shareholders get loud and get active. They would much prefer it if we would all just shut up and go away and forget GameStop.

That's not going to happen. I for one am not going anywhere.

🍻

some more data going back to fiscal year 2005.

| Fiscal Year | Revenue | Net Income | Store Count | Revenue Per Store | Net Income Per Store | 10-K |

|---|---|---|---|---|---|---|

| 2005 | $3,091,783,000 | $100,784,000 | 4490 | $688,593.10 | $22,446.33 | link |

| 2006 | $5,318,900,000 | $158,250,000 | 4778 | $1,113,206.36 | $33,120.55 | link |

| 2007 | $7,093,962,000 | $288,291,000 | 5264 | $1,347,637.16 | $54,766.53 | link |

| 2008 | $8,805,897,000 | $398,282,000 | 6207 | $1,418,704.20 | $64,166.59 | link |

| 2009 | $9,077,997,000 | $377,265,000 | 6450 | $1,407,441.40 | $58,490.70 | link |

| 2010 | $9,473,700,000 | $408,000,000 | 6670 | $1,420,344.83 | $61,169.42 | link |

| 2011 | $9,550,500,000 | $339,900,000 | 6683 | $1,429,073.77 | $50,860.39 | link |

| 2012 | $8,886,700,000 | -$269,700,000 | 6602 | $1,346,061.80 | $40,851.26 | link |

| 2013 | $9,039,500,000 | $354,200,000 | 6675 | $1,354,232.21 | $53,063.67 | link |

| 2014 | $9,296,000,000 | $393,100,000 | 6690 | $1,389,536.62 | $58,759.34 | link |

| 2015 | $9,363,800,000 | $402,800,000 | 7117 | $1,315,694.82 | $56,596.88 | link |

| 2016 | $8,607,900,000 | $353,200,000 | 7535 | $1,142,388.85 | $46,874.59 | link |

| 2017 | $9,224,600,000 | $34,700,000 | 7276 | $1,267,811.98 | $4,769.10 | link |

| 2018 | $8,285,300,000 | -$673,000,000 | 5830 | $1,421,149.23 | $115,437.39 | link |

| 2019 | $6,466,000,000 | -$470,900,000 | 5509 | $1,173,715.74 | $85,478.31 | link |

| 2020 | $5,089,800,000 | -$215,300,000 | 4816 | $1,056,852.16 | $44,705.15 | link |

| 2021 | $6,010,700,000 | -$381,300,000 | 4573 | $1,314,388.80 | $83,380.71 | link |

| 2022 | $5,927,200,000 | -$313,100,000 | 4413 | $1,343,122.59 | $70,949.47 | link |

some more data, i'll make a new post for this but for now saving it here:

FY 2005 total stores: 4490 revenue: 3,091,783,000 net earnings: 100,784,000

FY 2006 total stores: 4778 revenue: 5,318,900,000 Net earnings: 158,250,000

FY 2007 total stores: 5264 revenue: 7,093,962,000 net earnings: 288,291,000 https://www.sec.gov/Archives/edgar/data/1326380/000095013408005892/d55358e10vk.htm

FY 2008 total stores: 6207 revenue: 8,805,897,000 net earnings: 398,282,000 https://www.sec.gov/Archives/edgar/data/1326380/000095013409006730/d66430e10vk.htm

FY 2009 total stores: 6450 revenue: 9,077,997,000 net earnings: 377,265,000 https://www.sec.gov/Archives/edgar/data/1326380/000095012310030164/d70778e10vk.htm

FY 2010 total stores: 6670 revenue: 9,473,700,000 net earnings: 408,000,000 https://www.sec.gov/Archives/edgar/data/1326380/000095012311030842/d80233e10vk.htm

FY 2011 total stores: 6683 revenue: 9,550,500,000 net earnings: 339,900,000 https://www.sec.gov/Archives/edgar/data/1326380/000119312512134615/d283661d10k.htm

FY 2012 total stores: 6602 revenue: 8,886,700,000 net earnings: - 269,700,000 https://www.sec.gov/Archives/edgar/data/1326380/000119312513140443/d469015d10k.htm

FY 2013 total stores: 6675 revenue: 9,039,500,000 net earnings: 354,200,000 https://gamestop.gcs-web.com/static-files/3eb3d63d-81ac-484b-a131-ed7ab2d0ecaa

FY 2014 total stores: 6690 revenue: 9,296,000,000 net earnings: 393,100,000 https://www.sec.gov/Archives/edgar/data/1326380/000132638015000078/form10k-fy14.htm

FY 2015:

total stores: 7117

revenue: 9,363,800,000

net earnings: 402,800,000

https://www.sec.gov/Archives/edgar/data/1326380/000132638016000323/a10ka-fy15q4.htm

FY 2016: total stores: 7535 revenue: 8,607,900,000 net earnings: 353,200,000 https://www.sec.gov/Archives/edgar/data/1326380/000132638017000046/a10k-fy16q4.htm

FY 2017: total stores: 7276 revenue: 9,224,600,000 net earnings: 34,700,000 https://www.sec.gov/Archives/edgar/data/1326380/000132638018000033/a10k-fy17q4.htm

FY 2018: total stores: 5830 revenue: 8,285,300,000 net earnings: -673,000,000 https://www.sec.gov/Archives/edgar/data/1326380/000132638019000052/a10k-fy18q4.htm

FY 2019: total stores: 5509 revenue: 6,466,000,000 net loss: - 470,900,000 https://www.sec.gov/Archives/edgar/data/1326380/000132638020000022/a10k-fy19q4.htm

FY 2020: total stores: 4816 revenue: 5,089,800,000 net loss: -215,300,000 https://www.sec.gov/Archives/edgar/data/1326380/000132638021000032/gme-20210130.htm

FY 2021:

total stores: 4573

revenue: 6,010,700,000

net loss: -381,300,000

https://www.sec.gov/Archives/edgar/data/1326380/000132638022000021/gme-20220129.htm

FY 2022: total stores: 4413 revenue: 5,927,200,000 net loss: -313,100,000 https://www.sec.gov/Archives/edgar/data/1326380/000132638023000019/gme-20230128.htm

couple more years were available on SEC EDGAR:

nice post OP! love your original art.

it often takes me a while to figure out what it says when looking at the static images. this one took me a solid 2 minutes.

TERMINATE DSPP!

Another example, January 29, 2024.

Why do they do this shit? What possible benefit do the moderators of superstonk get by posting this? Why are they trying so hard to stay in control of the narrative? Why do they act as if they are an authority on this topic?

The last time GameStop posted positive full-year earnings was in 2017.

There has been a fair amount of talk of GameStop posting full-year profitability for the 2023 fiscal year, which is definitely within reach, but not guaranteed.

If GameStop posts full year earnings for FY23, it will be the first time in 6 years. It will be a momentous occasion!

It will also demonstrate that the prevailing sentiment put out by mainstream media doesn't reconcile with the reality that this company is not the loser that they want the world to think it is.

sorry, correction, not ALL of the information in the chart was exclusively from that section of the 10-Q, there was also this section of the revenue:

December 6, 2023: GameStop reports 2023 Q3 quarterly results

Net loss of $3.1 million for the quarter

All of the information in this diagram is derived from this section of the 10-Q:

all in all it was a decent movie.

"but it doesn't talk about [insert thing here] so therefore it was not good!"

i disagree with that notion. no such thing as bad press, and all that, and this movie isn't even bad press. it was fun and entertaining, which is typically the purpose of most movies. it was not a fact-based documentary, it's hollywood entertainment that is shining a light on an important story.

i do find it funny how much hate the movie is getting in superstonk.

In any kind of situation, sorry if I sound like a broken record here, but I always ask myself: who benefits?

We know that Public Relations is something that exists as an industry and as a component of businesses. Businesses use PR in order to shape public perception, away from something negative and sensitive to the business and towards something positive and helpful for the business.

E.g.: what did tobacco / cigarette companies do when research started coming out demonstrating that cigarettes caused cancer? Were those companies honest and forthright, and admit to this true reality even though admitting it would hurt their sales? Or did they do everything in their ability to obfuscate the truth and confuse people, because those actions led to an outcome of continued profits for the company?

We know that wall street and other industries make use of shill farms. Shill farms are basically the modern evolution of PR. If you are a wealthy and powerful incumbent and you are not using shill farms, you will fall behind and lose control of the narrative.

so, in a contest of "promote Dumb Money because it brings positive attention to GameStop", versus "Dumb Money sucks and was bad and was not good and I hated it and it didn't properly represent the story", which one of these thought processes is helpful to GME investors and which one is not?

And in consideration of that, why is it that superstonk is so loaded with antagonism towards this movie?

I think you might be right, though it is impossible to know for sure.

Like how the price started pumping a few days prior to December 6 earnings because those earnings were going to be decent and cause a positive reaction. So they get ahead of the positive reaction by preemptively pumping it beforehand for the purpose of preventing or slowing any momentum. This is what i suspect happened and may happen again in March of this year prior to earnings date.

Another kind of example of the censorship and confusion on this topic that continues to happen to this very day. It is for this reason why the subject needs to be repeatedly discussed and understood by as many GME shareholders as possible, because to this very day they continue to censor and confuse this topic to varying degrees.

January 23, 2024: a post that provides good information about the distinction between DRS and DSPP numbers gets removed from superstonk.

Even if well intentioned, posts like these ultimately are encouraging selling of shares, turning off autobuys, and sowing distrust in ComputerShare. The sources provided don’t back up these claims and how one person is interpreting this does not mean it’s fact. Please do your own due diligence when it comes to making decisions for your investment. Rule 6.

Why is this topic so contentious? Why has there been a sustained campaign to censor and confuse this specific topic, the topic of the distinction of DSPP and DRS, the fact that plan is not DRS?

Who benefits if it is crystal clear and all GME investors understand the truth? GME investors benefit. Who benefits if it is confusing and controversial and omitted (censored) from conversation? Not GME investors.

Great post. Insightful but not surprising.

From the perspective of a money-seeking billionaire like this, everything in the world is only as valuable as its measurement in dollars. Really, this type of behavior is completely normal and maybe even "smart", from the perspective of a capitalist system that rewards greed above all else.

If I am not mistaken, I also read that both Meta and Google, during the big hiring spree of 2021 / 2022, deliberately over-hired thousands of employees with no real work for them, just so that the competitors couldn't get those employees.

Imagine having so much excessive money that you can pay thousands of employees just to do nothing, simply so that your competitors might not get them.

Corporate behavior in modern capitalism is pretty fucked up. It's great if you are one of the few ultra wealthy individuals and all you care about is making more money than you even know what to do with. But beyond them, it's a ruthless and unfair system that will spit you out without a second thought, if it means some rich bastard can make even more money.

TLDR:

-

CNBC is financial propaganda designed to further the interests of its owners.

-

CNBC is owned by Comcast, which is 88% owned by institutions (Wall Street)

-

The owners of CNBC is Wall Street, and what Wall Street wants is more money and power for themselves and less for everybody else.

-

When a person watches CNBC, they are consuming information designed to take money out of their pocket and put it into Wall Street's pocket.

-

The purpose of CNBC (and other financial propaganda outlets) is to help Wall Street get more money and power for themselves and less for everybody else.

-

-

I recently saw this post and it made me curious to see how Upstart has fared since that CNBC interview was originally aired.

the original video clip appears to be from an October 15, 2021 CNBC interview with a guest by the name of Mark Minervini.

If you go to that CNBC link to view the clip, you will not find the part where Mark Minervini reveals that he has no idea what Upstart Holdings even does, this part has been conveniently removed.

Wikipedia says: "Upstart is an AI lending platform that partners with banks and credit unions to provide consumer loans using non-traditional variables, such as education and employment, to predict creditworthiness. "

By matter of pure coincidence, October 15, 2021, the same day that the original CNBC interview aired, was also the same day that Upstart Holdings was at an all time high market valuation.

So, recap:

-

in late 2020, some company that nobody has ever heard of called Upstart Holdings, ticker UPST, that performs some vague "AI lending platform", does an IPO

-

UPST rises from IPO all the way until October 2021.

-

October 15, 2021, wall street finance propaganda channel CNBC gets some stooge to sit in front of a camera and shill for some ticker that he doesn't even know what it is. "Upstart is up about 25 percent just in four days, that's a good looking name. Very powerful, very strong earnings, " this is the type of great due diligence that CNBC has to offer here. It's a great stock because it's up and up is good. Put your money in now, because stock goes up.

-

(the movie The Big Short draws attention to this concept of "Hot Hands" that is a bias that people have: "people think whatever is happening now is going to continue to happen into the future")

-

October 15, 2021, to present: UPST is down more than 90% since CNBC was pumping it.

-

-

Who owns CNBC?

CNBC is owned by Comcast, which is 88% owned by institutions (Wall Street)

What is CNBC's purpose?

The purpose of CNBC is the same purpose any propaganda machine.

Wikipedia provides this handy definition of propaganda, emphasis mine: > Propaganda is communication that is primarily used to influence or persuade an audience to further an agenda, which may not be objective and may be selectively presenting facts to encourage a particular synthesis or perception, or using loaded language to produce an emotional rather than a rational response to the information that is being presented. Propaganda can be found in a wide variety of different contexts.

Propaganda is the art of manipulating the perception of the target audience using a variety of lies, deceptions, and omissions of information.

It has been famously said that all warfare is based on deception.

For example in the context of a war, propaganda can be used to motivate your own troops by selling a perception of strength and success, and it can be used to demoralize your opponent's troops by selling a perception of weakness and defeat. In war, propaganda is simply a tool used to help the war-interests of the party that is utilizing the propaganda.

It's the same in the world of finance. Financial propaganda is designed to manipulate perceptions so that the person or party that is doing the manipulating may somehow benefit.

The owner of a propaganda machine like CNBC deploys the art of deception and the outcome is that the audience that consumes it subsequently hands over their hard earned money willingly and places it into the possession of that same propaganda owner.

The victim is led to believe that the information they consumed was a hot tip that might help them make some more money, but of course it was actually just a trap that took their money and gave it to Wall Street in stead.