The default web interface is awful, at least on mobile.

Hoping to find something decent at searching sorting and filtering.

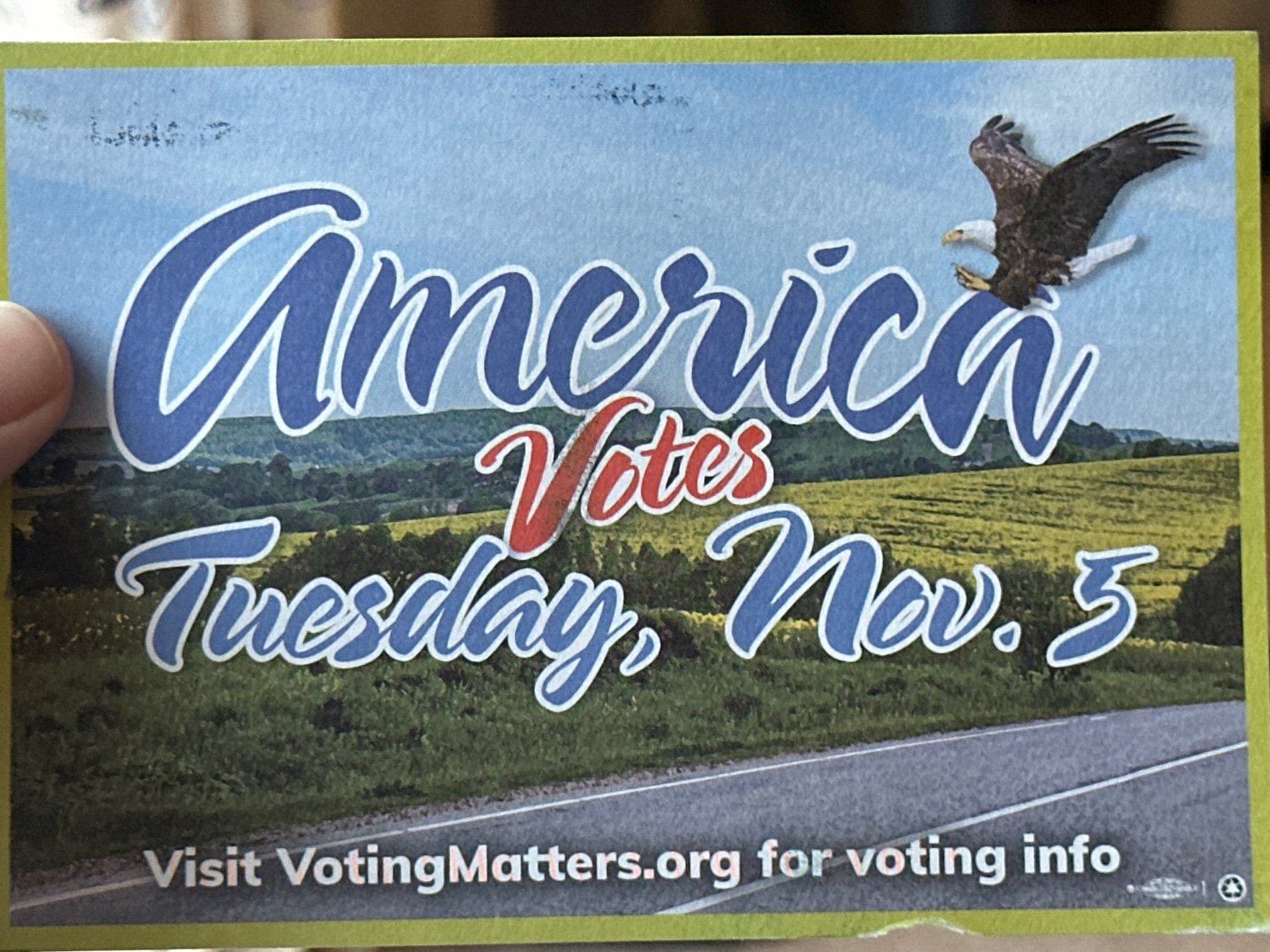

I finally caught another of the YouTube ads and it was paid for by futureforwardusa.org.

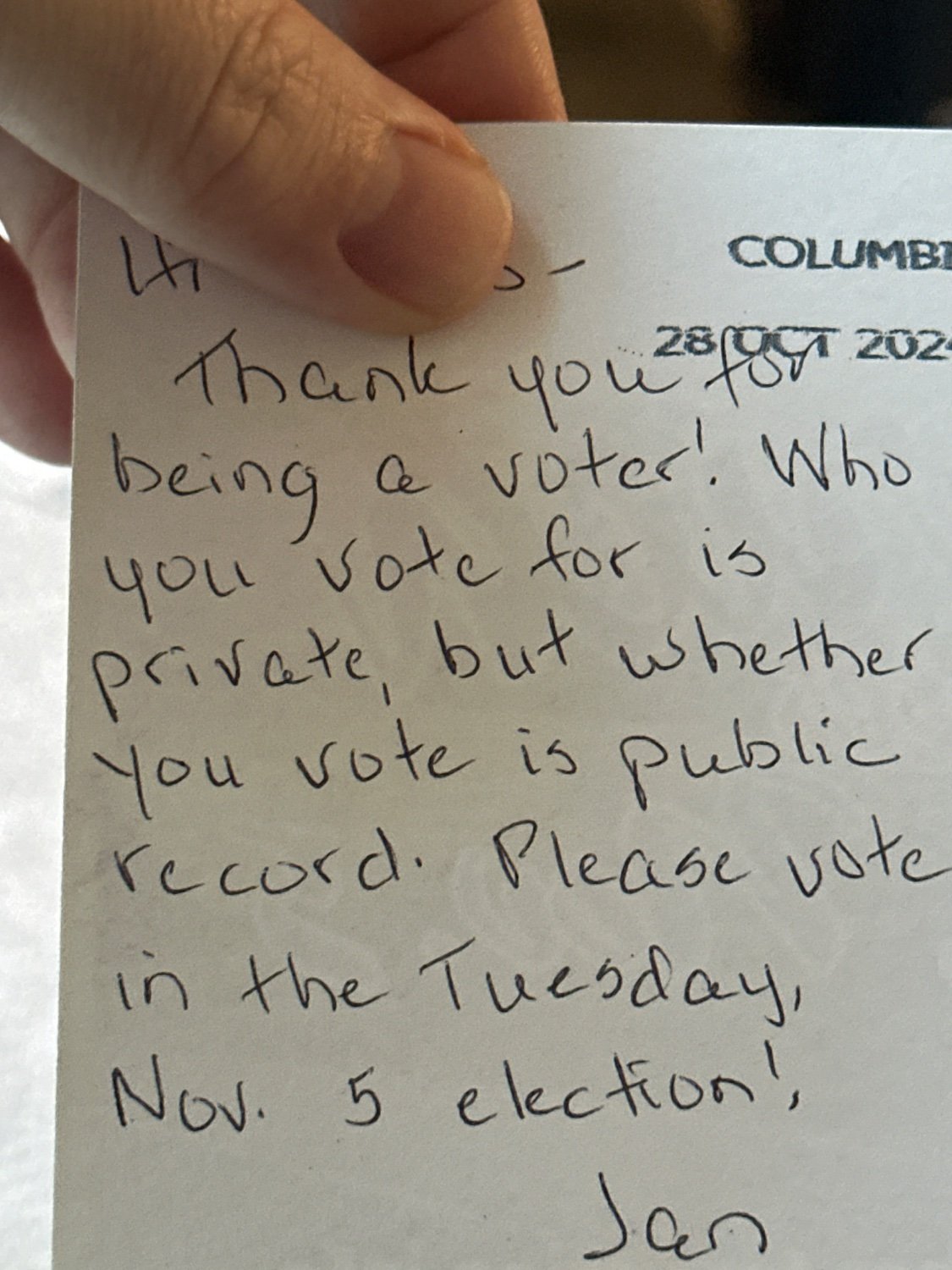

The message, again, was very generic with friendly animation and cheery music. The message was the same. “Your vote is private; whether you vote is public” with the addition of “make a plan to vote”.

Let’s say “marginalized groups”…

I’ve mostly seen YouTube ads so not sure how to share those here. I happened to get another postcard today though, with the exact same wording is the one I linked to elsewhere in this thread:

If you look at votingmatters.org it says:

Paid for by the Democratic National Committee (202) 863-8000

This communication is not authorized by any candidate or candidate’s committee.

I’m honestly surprised Republicans are doing this unless it’s extremely targeted.

Increasing voter turnout generally works against them.

This is the first clearly partisan one I’ve seen.

Mostly I’ve seen them as videos that plainly state. “Who you vote for is secret. Whether you vote is public record”. I did get one handwritten postcard saying the same.

I found them mostly “interesting” as a concept, but others have felt they’re threatening:

The first one I saw I looked up the “Paid for by…” entity and it was a Kamala PAC so I just kinda assumed they all were before seeing this.

Both parties are running these style ads in my area.

This is BY FAR the creepiest iteration I’ve seen.

Yeah. I tried and failed to head it off at the pass. There are some good comments in here though.

I think the logical thing is to have those who most benefit from the infrastructure our taxes pay for

The poor benefit from roads, schools, firefighters, Medical/Medicaid, and utilities as much as anyone. But I think you had the super wealthy in mind. “Those who benefit from infrastructure” is an odd way to pinpoint the super wealthy.

Those who “most benefit” would be those who have been able to leverage the infrastructure and security provided to profit wildly. Not those who are just scraping by.

I think we do agree on all but degree like you said. And maybe mean/median income is too high. I was just trying to come up with a somewhat natural but objective breaking point. I think a more reasonable but also more subjective one might be the “living wage” which will certainly be much lower than mean/median but also much higher than $13k.

P.S. Tangentially related, I found this living wage calculator which put my current LCOL residence at ~$42k and my previous HCOL residence at ~$57k. Turned out to be much closer to Mean/median than I expected.

The standard deduction should be at least the median income…? Wouldn’t that mean that half of people would pay no income tax?

Half or more depending on mean or median. But that’s just a starting point for the discussion.

You might say this is what we should do, but I think it’s unreasonable to say that it’s a total head scratcher why we don’t already.

That’s not what I was intending to ask. Sorry if I phrased it poorly. I’m trying to understand the arguments against it because it’s what makes sense to me.

I just fail to see how this is placing the burden on the poor. It Is structured to do the exact opposite and give them the most breaks.

I think the logical thing is to have those who most benefit from the infrastructure our taxes pay for be the ones who contribute the most. And those that are seeing the least benefit be exempt.

I’d probably agree that the floor on the deduction should come up, and we should raise taxes on extreme wealth to make it up. But at least in its most essential form, income tax is already progressive.

This is almost exactly what I suggested. I think we’re basically on the same page.

What about Karma (or whatever it’s called on Lemmy?) my understanding is it doesn’t “officially” exist but some apps are able to surface the stat anyway?

Counterpoint: You’re the bad friend for asking your friend to help you with a dead body

The argument is that if you take some money from a lot of people, you get more money than if you take a lot of money from some people.

That’s all dependent on how much you’re taking and from who which I addressed in my comment.

There's also the argument that if everyone pitches in, the overall burden for each individual is less.

This only makes sense if you define “burden” with a fixed dollar amount. A $6k tax “burden” is going to be a much harder burden on someone who makes $40k than someone who makes $250k

What this fails to address is that the richer you are, the more you can play with your money and end up with nothing to tax.

This could be addressed by the wealth tax I mentioned.

In the end, I do believe it’s politics and the wealthy manipulating people’s perception.

They’ve got us focused on this bullshit culture war when what we need is a good old-fashioned class war.

I’m looking for serious answers to understand the mentality. Please avoid the snark. I know it’s low hanging and tempting but I’m pretty sure most, if not all, of use here on Lemmy “get it”.

I just can’t get out of my head how absurd it is that we, in the U.S. anyway, put so much of the tax burden on working class folks instead of those most benefiting from our economic system.

It seems to me the standard deduction should be at least the median personal income (~$40k) if not the mean(~$60k) with progressive tax brackets adjusted to cover costs thereafter and possibly a supplemental wealth tax.

But I’m not an economist so trying to understand why I’m wildly wrong and this would be a terrible idea either from an economic perspective or from a political perspective.

11% went for Johnson

In 2016 the kids favored Clinton by 17 points (36% Trump to 53% Clinton)

they never shut the fuck up

Just wait til the day after the election thru the following 3.5 years

Why is ‘illegal worker’ in scare quotes?

No one knows the cure.

Read the complaints submitted to the FTC by users of Donald Trump's social media platform.

cross-posted from: https://slrpnk.net/post/13880568

> Tim Walz, you've been fact checked! > > > Trump reported millions in negative income in 2015, 2016, 2017 and 2020, and he paid only $750 in federal income taxes in 2016 and 2017. > > https://www.nbcnews.com/politics/donald-trump/trumps-tax-returns-released-house-committee-years-legal-battles-rcna62408

> Nestled in the Appalachian mountains, the community of Spruce Pine, population 2,194, is known for its hiking, local artists and as America’s sole source of high-purity quartz. Helene dumped more than 2 feet of rain on the town, destroying roads, shops and cutting power and water.

And even further, only those exact same two seats are ‘taken’ for every single showing.

I thought for sure the after church showings tomorrow would be at least somewhat full, but nope.

As it stands, If I want to view a post in the browser, I can use the ‘Copy’ option which gives me the comment or post’s URL and have to manually launch the browser, paste, and go.

So not the end of the world or anything, but a little annoying on the rare occasions I want to use it.

> The film's score was composed by Joe Strummer, former member of the punk rock band the Clash; the film's soundtrack contains a number of popular and alternative punk rock, skaand new wave songs.

My best friend's sister's boyfriend's brother's girlfriend heard from this guy who knows this kid who's going with the girl who saw Tim pass out at 31 Flavors last night. I guess it's pretty serious.

Unnamed sources have confirmed that Walz once claimed a task would be “a piece of cake” when it, in fact, turned out to be somewhat challenging.

When will this madness end?

I'm Bobby Newport Donald Trump and I approve this message