This boomer couple would be hit with $700,000 tax bill if they sold their mansion

This boomer couple would be hit with $700,000 tax bill if they sold their mansion

This boomer couple would be hit with $700,000 tax bill if they sold their house

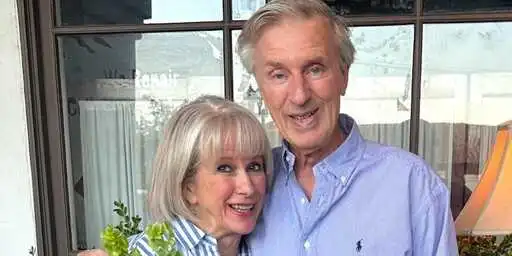

Joel and Kathryn Friedman, both 71, are counting the days until they can sell their home and move into a 55-plus community.

The retired empty-nesters have been ready to downsize for years, but are reluctant to sell their five-bedroom, 5,000-square-foot Southern California house [mansion] in large part because of at least $700,000 in capital gains taxes they estimate they'd have to pay.

Since 1997, home sale profits over $500,000 (for married couples) and $250,000 (for single filers) have been subject to a capital gains tax of up to 20%. That threshold hasn't changed since 1997, meaning that — between inflation and soaring home prices pushing an ever higher number of houses above that limit — many more home sellers have to pay the tax now than when it was first implemented.

The Friedmans are among a growing number of older homeowners discouraged by the tax from selling their valuable properties. Housing economists say that dynamic has exacerbated a shortage of family-sized homes on the market, especially in expensive places like California.

The Friedmans' house is too big for them, and maintenance costs are only rising, Joel said. "There are a million reasons why we'd like to move, but we're not because the tax is just burdensome," he said.

But that could change — there's bipartisan support in Congress for raising the federal tax threshold to boost home sales in a stagnant market.

In other words, their house would sell for at least 3.5 million. Where exactly is the problem?

3.5 million is the increase in value over what they paid. That means they were making well over $100,000 every year for the past three decades, and they are complaining about paying cap gains.

Fucking Boomers.

Although increasing the exemption amount to peg inflation does make sense.

Also, fucking Business Insider for running this obvious tripe.

Not surprising from an outlet created by DoubleClick founders and a guy who is barred from exchanges due to securities fraud.

Also capital gains on a primary residence should decrease somewhat over time.

These arent property speculators or people buying and parking empty homes. They are people who bought a house, lived in the community, probably raised a family and didnt move for 30 years and now want to downsize.

Uh... How is one's house appreciating in value equivalent to making money? It's impossible to access most of that money because, you know, they need somewhere to live, and according to the article the difference is supposed to pay for their retirement and healthcare. I have no idea how the math will turn out but 1-2 million for two 71 year-olds looking to live for 15-ish years in Southern California isn't outrageous at all. The fact it seems outrageous is purely due to how completely fucked up everything has become for the working class over the past few decades.

They don't want to contribute to society, even at a lower rate than wagies.

This is exactly the problem.